Employer Max Contribution 401k 2025. Such as contribution limits and income thresholds. However, there is a limit that applies to total contributions, meaning the sum of the employee portion and employer match.

Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025. You can contribute an additional $7,500 for a total of.

In 2025, the 401 (k) contribution limit for participants is increasing to $23,000, up from $22,500 in 2025.

401k 2025 Limit Over 50 Aggie Sonnie, For 2025, the contribution limits for 401 (k) plans have been increased. However, there is a limit that applies to total contributions, meaning the sum of the employee portion and employer match.

401k Max Contribution 2025 Include Employer Match Nelie Joceline, Those 50 and older can contribute an additional $7,500. In 2025, the 401 (k) contribution limit for participants is increasing to $23,000, up from $22,500 in 2025.

Max 401k Contribution With Catch Up 2025 Alia Louise, The 401(k) contribution limit is $23,000. In 2025, the 401 (k) contribution limit for participants is increasing to $23,000, up from $22,500 in 2025.

401k 2025 Contribution Limit Chart, In 2025, the contribution limit for a roth 401 (k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older. Such as contribution limits and income thresholds.

Annual 401k Contribution 2025 gnni harmony, For 2025, the employee contribution limit for 401(k) plans is $23,000, up from $22,500 in 2025. What is the 401k maximum for 2025 golda kandace, in 2025, the 401 (k) contribution limit for participants is increasing to.

2025 Max 401k Contribution With Employer Maryl Jenine, Employees can contribute up to $23,000 to their 401 (k) plan for 2025 vs. Employees can contribute up to $22,500, up from $22,000 in 2025.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, The 401(k) contribution limit is $23,000. The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

2025 Irs 401k Max Donni Gaylene, Max 401k contribution 2025 including employers. In 2025, the contribution limit for a roth.

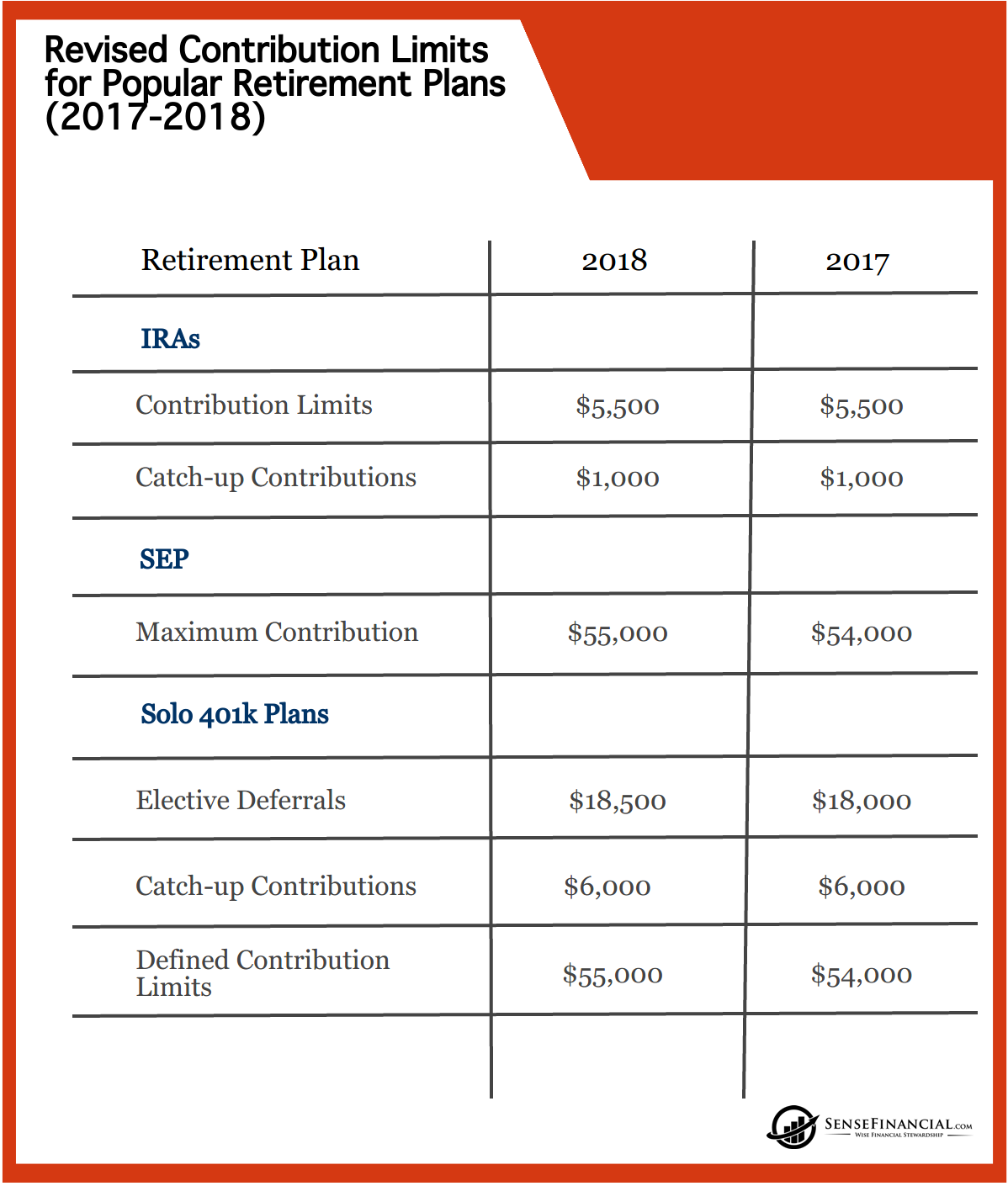

Infographics IRS Announces Revised Contribution Limits for 401(k), Most people don't max out their 401(k). You can contribute an additional $7,500 for a total of.

401k Maximum Contribution Limit Finally Increases For 2019, For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 2025 401 (k) limit of $22,500. Employees can contribute up to $22,500, up from $22,000 in 2025.